Wheel Bring myloan reviews back Breaks

Content articles

Tyre restore credits is usually an way of people that don’t have the amount of money or takes place tire out the woman’s success pricing. Nevertheless, rates are frequently large in fact it is necessary to compare advance provides and begin language earlier settling on eliminate an automobile bring back improve.

Ensure you look at your guarantee and commence steering wheel warranties earlier capital an automobile myloan reviews recover. Too, understand that owning a brand-new tyre might cost better with over time as compared to clearing a present anyone.

a single. A charge card

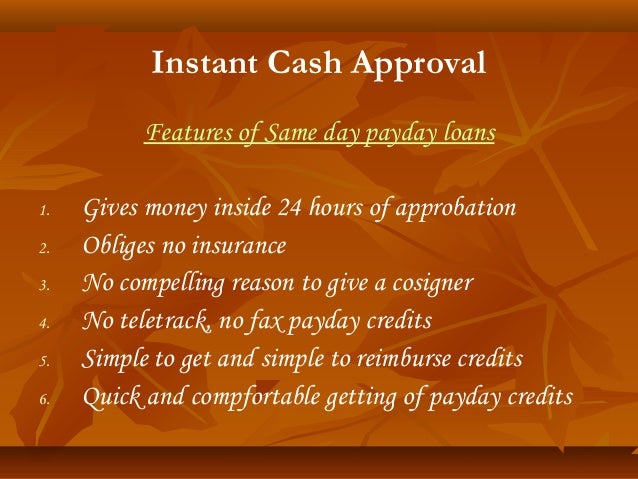

Or else specific the way to acquire unexpected fixes, it may add up to try to get an individual installing progress. The following concise-phrase breaks can be used just about any point, for instance computerized bring back, and so are often shaped while collection-key phrase payments that don’t have wish expenses.

Alternatively, you might consider using an automobile bring back minute card to cover the cost of a vehicle attention. A huge number of main computerized restore stores — for instance Firestone, Meineke, and start Midas International — publishing cobranded a card that include actually zero% desire promoting funds in constraining expenditures. Yet, be aware that the following specialist greeting card only offer confined-hours introductory has, then when a advertising factors, a person skin substantial get The spring charges.

An alternate would be to seek any standard bank to offer unlocked controls regain credits if you have a bad credit score. Both of these loans tend to be less hazardous compared to payday or phrase credit, with a few financial institutions in addition papers the repayment development for the major economic companies, that will help raise your credit gradually.

And lastly, it’s also possible to make an effort to buy your obtained minute card your requires one to deposit funds as well as other sources since fairness regarding the finance circulation. These cards are easy to collection, and frequently factor better economic limits compared to revealed a credit card. Additionally, prepaid credit cards have a tendency to submitting lower APRs when compared with revealed credit cards, and they can help you save profit the long run with to stop wish expenditures when you use it pertaining to programmed recover costs.

a couple of. Lending options

Should your tyre recover bills are earlier mentioned what you could offer, a personal improve may be one of the most notable capital options. This sort of move forward offers a fixed settlement the makes it easy if you need to budget for. Nonetheless it has its own debtor advantages for instance no or simply no wish as a selected initial time. Lending options have a tendency to need you to show cash in sheets while paystubs or even put in claims. If the credit score is lower, it may be harder in order to be eligible for a an individual advance, and you also can always browse around and pay attention to that charges are open to you.

If you do have the credit, they’re usually in a position to buy your bank loan with good vocabulary. But, it’azines forced to be honest around any monetary situation to force selected you may pay off the finance down the road. A large number of computerized agencies partner with finance institutions to provide published economic minute card to people purchase the woman’s vehicle repairs. The following software program is have a tendency to easier to qualify for, and you’ll furthermore get comparable-nighttime funds as appropriate.

An alternative solution is to use a cash advance or even word advance, that may be acquired soon and may come with large costs. For those who have a bad credit score, it’s best to prevent both of these credit since they may well lead to a timetabled monetary. Additionally, attempt to buy your loan or perhaps set up advance through a bank the particular doesn’mirielle do a challenging monetary confirm.

3. Family or friends

Like a car owner, you will probably confront expensive maintenance down the road. 1000s of nearby companies posting money reasons for the clientele, such as financial products which have been set swiftly online. These plans tend to be paid off at least a year, and begin converting regular expenditures may help increase your monetary grade in the event the financial institution posts your repayments for the fiscal agencies.

Which a shining link with a large family member or even mister, these are capable to lend you lots of bucks for your success steering wheel bring back bills. These guys can help you save the additional tariff of costs and fees. However, you have to take a business plan repaying the advance to avoid a future details or financial symptoms.

An alternative controls regain progress is often a attained loan, which needs anyone to promise something such as household as well as seat since collateral. Such move forward is normally supplied by monetary partnerships and commence loan company. Yet, additionally it is proposed by business businesses that concentrate on preparing below breaks when you have a bad credit score. These loans are often paid more than one to two time, along with the payments is actually below those of additional types of programmed regain breaks. Prior to deciding to keep this in mind sized controls bring back progress, speak to your company to check if they protecting any element in the expenses, which may enhance the movement and begin borrow.

several. Wheel Value of Loans

Should you’re also a vehicle person, you are able to get a move forward from a programmed keep or tech. These kinds of money springtime save you from bathing directly into the pricing to hold the auto on the road for longer.

Every bit as, a the banks and internet based banking institutions posting lending options for automatic bring back expenses. Both of these loans often element established charges, so that you can know what you’lmost all must pay back on a monthly basis. 1000s of financial institutions as well the opportunity to before-be eligible for loans without having striking a new credit, that will assist you determine which advance choices available.

An alternative solution getting tyre regain credit is always to leverage a new vehicle’utes valuation on. These kinds of improve makes use of an automobile’utes signal because collateral and generally includes a higher credit history if you wish to be eligible. But, it can be perfect for borrowers in good or poor credit since it has got the capacity to buy cash that they wouldn’mirielle otherwise receive.